I know that before I figured out that we could retire, I was spending the excess money, and spending it on silly things. But I think that threshold is different for different people. People often cite that study that above 70-80k (can't remember exact #), money doesn't buy happiness. And not all of us are going to walk away from a potential partner just because they aren't as frugal as we are. The only thing I'd say to these 25y single engineers living minimally and rocking huge savings rates is that it is a LOT easier alone. It works out well enough that we are both happy. My compromise is to give her a budget each month to do those things, but in a controlled fashion. She just wants to buy a new set of lamps or finish furnishing parts of the house. And she doesn't really give a shit about how much $ we put into betterment each month, and her eyes gloss over when I talk about our quarterly growth in net worth lol. Personally, I'd love to have a higher savings rate, but I love my wife and want her to be happy. Yeah, I have about a 40% savings rate which sounds pretty awesome - but we have a dual income household where we could EASILY be saving upwards of 60% or more, especially if our monthly costs were comparable to others in this thread.

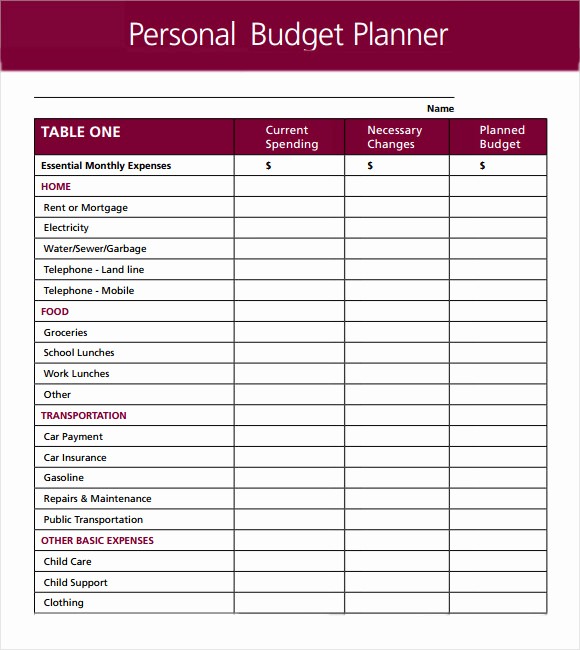

#Your normal monthly expenses free

Please read the FAQ and Rules above, then feel free to share your journey or ask for advice! When participating on this subreddit, please be mindful of the ways in which you are lucky. Taking the slow road, or the traditional road to retirementīecoming financially independent requires hard work and a healthy attitude towards money, but also a degree of privilege. Gaining wealth for the purpose of excessive consumption Investing to make your money work for you, and learning to manage/optimize those investments for the unique nature of FI/RE Striving to save a large percentage (usually more than 50%) of your income to accelerate achieving FI

Working to increase your income and income streams with projects, side-gigs, and additional effort Your wants and needs aren't written in stone, and less spending is powerful at any income level.

Simplifying and redesigning your lifestyle to reduce spending. The purpose of this subreddit is to discuss FI/RE strategies, techniques, and lifestyles whether you are retired or not.ĭiscovering and achieving life goals: “What would I do with my life if I didn't have to work for money?"

This subreddit deals primarily with Financial Independence, but additionally with some "RE" concepts.Īt its core, FI/RE is about maximizing your savings rate (through less spending and/or earning higher income) to achieve FI and have the freedom to RE as soon as you wish. This is a place for people who are or who want to become Financially Independent ( FI), which means not having to work for money.īefore proceeding further, please read the Rules & FAQ! Rulesįinancial Independence is closely related to the concept of Early Retirement/Retiring Early ( RE) - quitting your job/career and pursuing other activities with your time.

0 kommentar(er)

0 kommentar(er)